P87 Form Expense Categories Explained Simply

Important: Before We Dive In

Before we move on to explain the categories you’ll see in the P87 form, we need to make something clear:

P87 Form Categories ≠ Allowable Expenses

What do we mean? The P87 form cramps all expenses you’ve done throughout the year and jams them into categories that the HMRC will understand.

The problem is that the form fails to explain what can and what can’t go into each one of these pre-set sections. This is what we mean when we say Allowable Expenses.

The most important thing to remember is that the categories you see in the HMRC’s P87 form are NOT the only types of expenses you can make.

Let’s break this down, shall we?

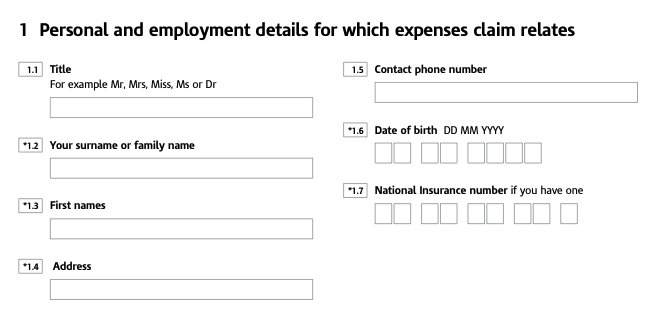

P87 Section 1: Personal Details

Before we dive into the expense categories included in the P87 form, we must cover the first two sections of the document.

If you’re about to start filling a P87 form, you must tell the HMRC who you are, and as you can see, they request the most logical information, such as your name, address, date of birth, and national insurance number.

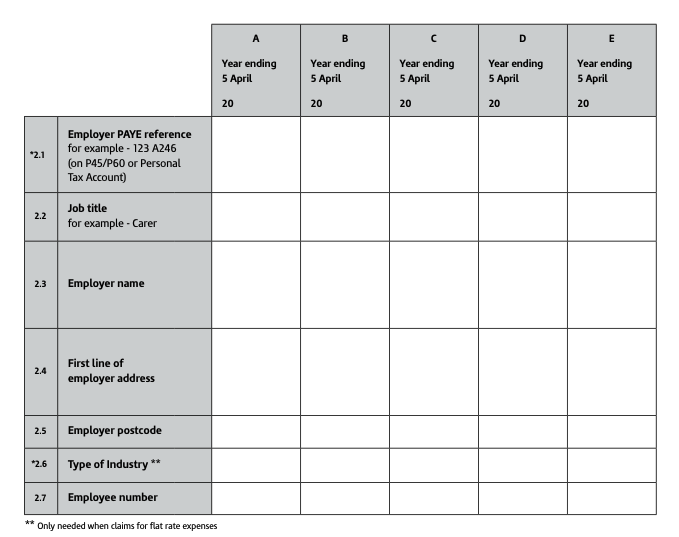

P87 Section 2: Employment Details

The Employment Details section of the P87 form asks you to complete the employer and year that you’re going to be claiming for.

This is a matrix section, so you can use it in one of two ways:

- If you work more than one job, you can dedicate a column to each employer (A is for job 1, B for job 2, etc.

- If you want to claim for multiple years, you can use each column for a specific year (you can claim up to 4 years back)

Pay attention to the “Type of Industry” section. To complete this field, use one of the industries listed HERE. Remember, that this section is only if you claim the flat rate expenses (pre-set amount). If you have more than the pre-set amount, you can opt out of it by simply not filling in the industry and making sure your employer hasn’t added it to your payslip.

P87 Section 3: Flat rate expenses

Flat Rate expenses are HMRC’s simple way of saying, “We know that some people will inevitably spend money for things, let’s estimate it”.

It’s similar to the way your water and gas/electricity usage is estimated – just an average that may or may not be true.

The HMRC have done this by profession and you can see the list here [CLICK LINK].

IMPORTANT: What you see on this list is not the tax that will be returned to you if you use a flat rate. It’s the total amount, meaning that final tax rebate is 20% off of whatever the flat rate is.

Example 1: NHS Nurse

If you’re an NHS nurse you can claim a flat rate expense of £125 per year, without having to keep receipts or any proof of the expense actually being made.

Your tax return in this case will be:

£125 * 20% = £25.00

Example 1: Construction Labourer

If you work as a labourer in the construction industry, you’re allowed to claim £60 per year without having to provide receipts. Your tax return will be:

£60 * 20% = £12.00

P87 Section 4: Professional Bodies

Some professionals (especially in regulated industries like finance, medicine, law, etc.) must be a member of a professional body in order to practice their jobs.

Others, like managers, marketers, advertisers, and others choose to join professional bodies to enhance their careers.

Whichever the case, the fees paid to these professional bodies are what we call an allowable expense. So, if you too pay for a membership or a publication related to your work, you’re eligible to get an HMRC approved “discount” of 20% via a tax return (tax rebate).

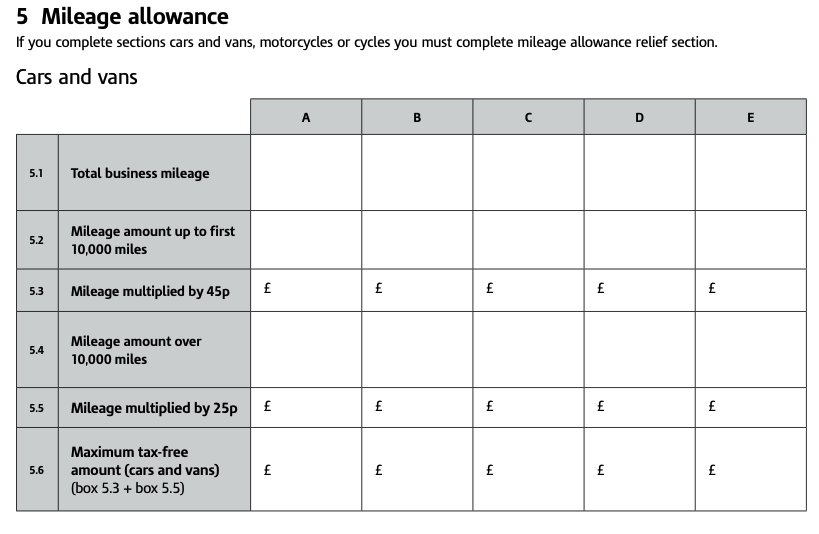

P87 Section 5: Mileage allowance

If you use your car, motorcycle, or even bicycle to travel for work reasons, the tax man allows you to get some of that expense back.

Here are 2 crucial factors:

- The travel shouldn’t be to your regular office: this category should only be used for out-of-ordinary travel, such as going to a training course, conference, or else.

- You employer shouldn’t have already paid you back: if the company you work for already repays you back for mileage, you can’t use this section, unfortunately…

P87 Section 6: Hotel & Meal Expenses

This category captures every single meal or overnight stay expense (hotel, WiFi, toothbrush) that you’ve done because of work.

Whether you’re staying in another town because of a client, or because of a training, it doesn’t matter: the costs you generate when travelling because of work can be claimed back.

And if your employer doesn’t cover these costs, at least you can get 20% of that expense back.

P87 Section 7: Other Expenses

This is perhaps the most confusing of expense categories in the P87 form, but we’ll try to simplify it.

The easiest way to think about Other Expenses is that it is for anything and everything you made as expense so you can do your work, but doesn’t fit into the previous categories.

This includes (but is not limited to) uniforms, tools, stationary, print materials, train tickets, expo and conference tickets, software, coffee or restaurant bill with a client, training courses, equipment, books, guides, catalogues, and others.

Head Scratchers (a.k.a. FAQ)

Yes, it is a legal requirement that you hold receipts for every single expense you make, except petrol station receipts.

And because this is such a tedious tax, the Peseta App was born – use it to collect your expenses as you go throughout the year, so filling in a P87 form becomes a few minutes task (instead of wasting days going through receipts).

If you’re looking for an intuitive way to understand it, there isn’t one (when was there ever anything intuitive about taxes).

The only thing we can advise you is that you follow us on social media, subscribe to our newsletter, and engage with us – we are 100% dedicated to demystifying the tax jargon.

Legally, the requirement is that you keep them for at least 22 months after the end of the financial year. This means that if you are claiming for financial year 2025 – 2026 (April to April), you need to keep the receipts until the end of January 2028.

We would urge you, however, to keep the receipts for at least a few years (5-6). But don’t store them as physical copies – snap a few photos, organise them in a folder and chuck them in the cloud.

As weird as it sounds, it ain’t about the money (as Jessy J would say). You can’t become a good chef without thinking about food, and you can’t become a runner without running. Just like that, you can’t become financially comfortable without thinking about money.

Starting your financial development with something as simple as getting 20% back on expenses you needed to make is perhaps the easiest way to get the adrenaline rush that you need to keep learning more and more, and to start winning in life.

Plus, £500 one year is nothing. £500 over 5 years with a 4.5% interest is £3,366.39, a.k.a. £366.39 more simply because of the interest rate…

Get a tax return for all of the expenses you make for work.

Expense Tracking App for Busy People

Peseta App is a quick and easy way to track your allowable expenses and export a calculated-for-you, ready-to-submit summary, so you can:

Get Your Money Back.